Amazon SEND/ShipTrack Carrier,Amazon SPN/Temu/Tiktok/Wayfair/Walmart Partner

U.S. tariffs are published by the United States International Trade Commission (USITC). Amazon sellers who need to check the export tariff for their goods should visit the official USITC website to find the latest import tariff rates.

First of all, US tariffs are announced by the United States International Trade Commission (U.S. International Trade Commission). If Amazon sellers want to check the tariffs for their goods exported to the United States, they need to go to the official website of the United States International Trade Commission to check the latest import tariffs.

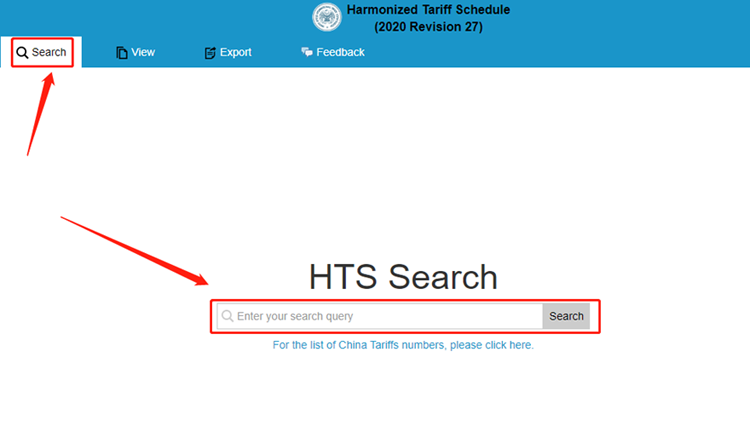

US National Commission official website tariff query website:https://hts.usitc.gov

First, go to the above website, check Search and then enter the first six digits of the HS CODE (customs code) you want to query US tariffs in the HTS Search below. For example, the HS CODE number of clothing is 610333******, search in the search bar below.

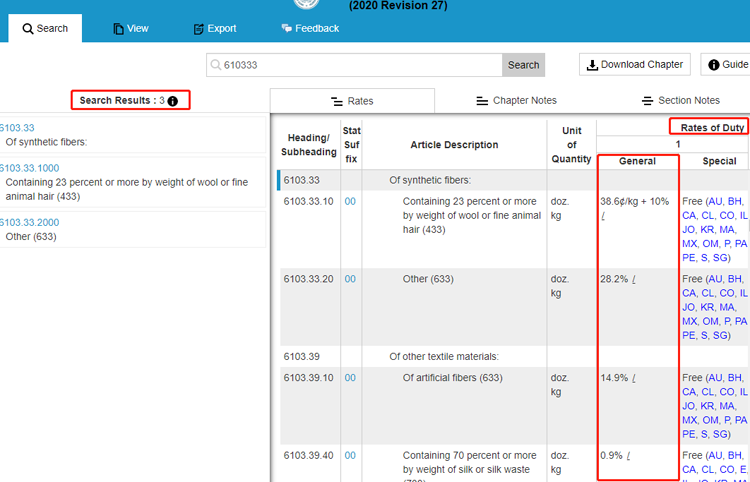

Then you can get information about US import taxes for all clothing.

From the Search Results:3 in the left column, we can see that there are 3 search results.

The General in the Rates of Duty column on the right column is the result of the import tariffs for clothes

in the United States. It can be seen that the tax on clothes is relatively high.

The 1st item in the General column refers to the tariffs on most imported products in

the world (including China),and the Special refers to the tariffs on imports from countries related

to the US free trade agreement (most of them are FREE, without China)

Item 2 refers to the tariffs of countries that have no trade relations or trade restrictions with the

United States (such as North Korea).

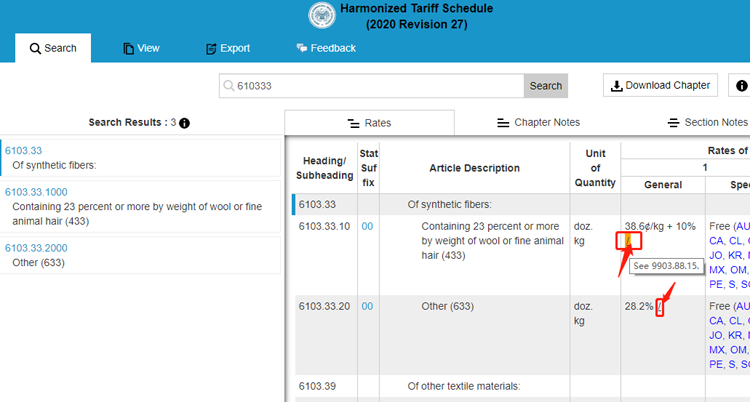

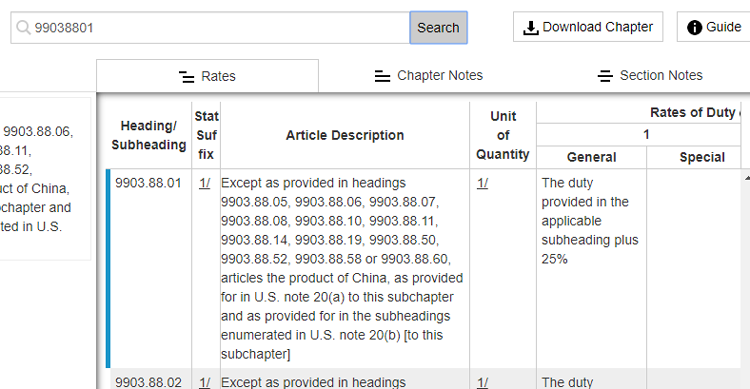

The first item means that if the fabric contains more than 23% animal hair, such as wool, an additional tax of 0.386 USD/kg will be added, plus a 10% tax. If you look closely, there is a slash at the end. When you click the mouse, a string of codes will appear, which means that the tax needs to be added. For example, if you search for 99038801, the tax is 25%, and if you search for 99038815, the tax is 7.5% (as shown below)

Some new Amazon sellers will ask, "I don't know what the HS CODE (customs code) of my product is?".HS CODE code can be found here:https://www.hsbianma.com,The first six digits of the customs code retrieved are internationally accepted.

It is best to check the latest US tariff changes before shipping. Maybe the goods that were exported normally last month have been subject to a 25% tariff this month. It is not a big deal if the goods have not been shipped yet, but when the goods are ready to be shipped or already at sea, you will find out that a 25% tariff will be added. Losing money is an indisputable fact, but how to deal with the goods is another matter. Continuing to sell will cause more losses, and returning the goods to China will be difficult.

WeChat Easy Scan

Online Consultation Easy Ordering